It is not always wrong to think positively in the midst of turmoil. I have tasked my bank's analysts to come up with the 'now is time again for going long' option (and very long blogwise)and stop thinking short-selling but contrarian-wise, contra-intuitively, how we can go forward here-on-in. The 'bullet-point, psychometric, feelgood-feelbetter, we-can-make-it-happen. "yes, we can" gurus, you just gotta really want something bad enough to make it big, animal-spirits back in the front-line, can-do Yankee culture, business strategy cheerleaders, home-team, self-help psychologists' et al, cannot be all wrong. Forget saving money; let's make money, go out there, and do the deals that truly believe in the Anglo-American capitalist model, that's what I tell the money folks. It's The Great Game all over again.

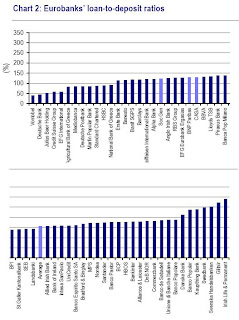

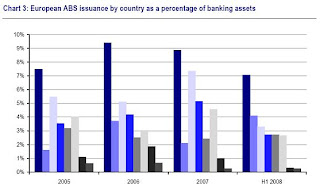

It is not always wrong to think positively in the midst of turmoil. I have tasked my bank's analysts to come up with the 'now is time again for going long' option (and very long blogwise)and stop thinking short-selling but contrarian-wise, contra-intuitively, how we can go forward here-on-in. The 'bullet-point, psychometric, feelgood-feelbetter, we-can-make-it-happen. "yes, we can" gurus, you just gotta really want something bad enough to make it big, animal-spirits back in the front-line, can-do Yankee culture, business strategy cheerleaders, home-team, self-help psychologists' et al, cannot be all wrong. Forget saving money; let's make money, go out there, and do the deals that truly believe in the Anglo-American capitalist model, that's what I tell the money folks. It's The Great Game all over again.  Readers of my columns expect mixed metaphors and slightly mad euphenisms. This one could be Central Asia's 'Great Game' where a few great heroes held off the Russian Bear at the North West Frontier in the mid-19th century that unfortunately has now lasted into the early 21st century, or the great game of making par for the course deals with businesses struggling with their golf handicaps, or spread-betting on cricket scores in Caribbean tax-havens, maybe rugby is the great game, blind-siding a ruckus to cross the line (Six Nations Championship decided Saturday by Ireland), or Spanish bullfighting, or maybe all of these, 'great games' when thinking about the team-plays needed to make vast fortunes now in Asset Backed Securities, even today, yes, especially today. Issuance in the UK has never been greater, but so far it's all being packaged for, to be 'bought in' like repo-swaps, by HM Treasury and the Bank of England. And, so far, the amounts are more than the total of UK banks 'funding gap' (at $1 trillion out of $7 trillion bank assets, or 3 times China's true GDP, or one third more than the 'funding gap' of all emerging market countries' banks put together - data source:BIS). Euro Area banks likewise are active bundling & packaging their loan-books for ECB and other central banks and finance ministries. 'Funding' is not the only gap. European banks in total have a $2 trillions 'US dollar' funding gap, but that's only one third of their customer loans to deposits funding gap and what's left of the Pfandbriefe market. 'Funding gap' between customer deposits and loans is met by borrowing 'wholesale finance' (from banks and non-banks) in the form of 3 month, 1, 3, 5, 10, 30, even 50 year covered (bank) bonds and securitised ABS loans, which are amortizing and constantly topped up i.e. rolling credit-assets (my term). But, over in the USA, where are US banks getting their new roll-over financing for their funding gaps, not so far as we can see yet from bond issuances, securitizations or covered bonds? I asked one of my analysts for a roadmap late last year (see next slide), but when I found it impenetrable I just had to let the guy go.

Readers of my columns expect mixed metaphors and slightly mad euphenisms. This one could be Central Asia's 'Great Game' where a few great heroes held off the Russian Bear at the North West Frontier in the mid-19th century that unfortunately has now lasted into the early 21st century, or the great game of making par for the course deals with businesses struggling with their golf handicaps, or spread-betting on cricket scores in Caribbean tax-havens, maybe rugby is the great game, blind-siding a ruckus to cross the line (Six Nations Championship decided Saturday by Ireland), or Spanish bullfighting, or maybe all of these, 'great games' when thinking about the team-plays needed to make vast fortunes now in Asset Backed Securities, even today, yes, especially today. Issuance in the UK has never been greater, but so far it's all being packaged for, to be 'bought in' like repo-swaps, by HM Treasury and the Bank of England. And, so far, the amounts are more than the total of UK banks 'funding gap' (at $1 trillion out of $7 trillion bank assets, or 3 times China's true GDP, or one third more than the 'funding gap' of all emerging market countries' banks put together - data source:BIS). Euro Area banks likewise are active bundling & packaging their loan-books for ECB and other central banks and finance ministries. 'Funding' is not the only gap. European banks in total have a $2 trillions 'US dollar' funding gap, but that's only one third of their customer loans to deposits funding gap and what's left of the Pfandbriefe market. 'Funding gap' between customer deposits and loans is met by borrowing 'wholesale finance' (from banks and non-banks) in the form of 3 month, 1, 3, 5, 10, 30, even 50 year covered (bank) bonds and securitised ABS loans, which are amortizing and constantly topped up i.e. rolling credit-assets (my term). But, over in the USA, where are US banks getting their new roll-over financing for their funding gaps, not so far as we can see yet from bond issuances, securitizations or covered bonds? I asked one of my analysts for a roadmap late last year (see next slide), but when I found it impenetrable I just had to let the guy go. This is no longer a spreadsheet world I told him and he forfeited his stock options. We are not bonus-friendly right now. Upside-potential revenue-earners we keep; problem-fakirs who want to short everything that moves this year like last year we don't. I told him and his team I'm much more interested in how we leverage ISDA's new global standard for credit default swap processing, the latest move by Group of 30 and others to address issues that arose after the collapse of Lehman Brothers five months back, and how we can profit from efforts with the World Bank and IMF to plug the $275bn funding gap shortfall in emerging markets banks! My ex-analyst at least provided a foretaste of the Geithner Stress-test to figure out NPV of all US banks going forward if we place all toxic assets into a big bad bank.

This is no longer a spreadsheet world I told him and he forfeited his stock options. We are not bonus-friendly right now. Upside-potential revenue-earners we keep; problem-fakirs who want to short everything that moves this year like last year we don't. I told him and his team I'm much more interested in how we leverage ISDA's new global standard for credit default swap processing, the latest move by Group of 30 and others to address issues that arose after the collapse of Lehman Brothers five months back, and how we can profit from efforts with the World Bank and IMF to plug the $275bn funding gap shortfall in emerging markets banks! My ex-analyst at least provided a foretaste of the Geithner Stress-test to figure out NPV of all US banks going forward if we place all toxic assets into a big bad bank. I am still at a loss to see how the US banks are financing their funding gaps. Published data is in very short supply, zero it seems. Maybe what they get from the Fed's TALF, FDIC guarantees, and Fed Liquidity Window is enough? If so, it must be eventually become $5-7 trillions enough, out of a total funding gap someways north of that? Precise data is hard to find. It's easier to uncover banks funding gaps in Europe.

I am still at a loss to see how the US banks are financing their funding gaps. Published data is in very short supply, zero it seems. Maybe what they get from the Fed's TALF, FDIC guarantees, and Fed Liquidity Window is enough? If so, it must be eventually become $5-7 trillions enough, out of a total funding gap someways north of that? Precise data is hard to find. It's easier to uncover banks funding gaps in Europe.  My guys could go through the waste baskets of the major banks published accounts or check the Fed's and FDIC backyards. For now, let's just ask the question. Gillian Tett in the FT (see comment at end below)tells us that private sector wholesale funding has dried up. At a Dublin conference I missed the hedge fund experts surmise that Hedge investment capital has shrunk since 2006 from over $2.5tn to close to $1tn! My data says the total is still up in the $2tn region? She also says the banks have stopped their proprietary trading (prop desks) except, in Europe, Goldman Sachs. She also says market-making has retreated, especially in credit markets. So liquidity has crunched, and the question is where is the wall of carpet-bagger money building in 'distressed funds' (the slightly politer term for 'vulture funds') circling and waiting to pounce on fire-sale price deals. Recession is always the time for the cash-rich to get spectacularly richer by buying productive assets, property and securities in anticipation of massive gains when recovery begins. Vulture Funds are building fire-power in the USA, why not in Europe too? Maybe it is all about who gets the Japanese, other Asian and ME sovereign funds on board ($ funds from export-surplus countries)? Ok, so either we invest in vulture funds or we finance banks funding gaps, or we pick up discounted banking-loans assets in securitised bonds at prices where further defaults do no harm, or pick up prime property and land, or maybe all of these. The question is price, timing and getting at the carcasses before the other vultures arrive. Meanwhile, stateside, the US banks are perhaps just treading water, holding hover, suckling at the breast of the Federal Reserve's short term liquidity window? I put this question to my auto-loans liquidity specialist and foreign trips special assistant, Ms Rita Chevrolet, to consider double-entry book-keeping issues of liquidity preferences in banks balance sheet treatments under GAAP, FASB, IAS and IFRS 7.

My guys could go through the waste baskets of the major banks published accounts or check the Fed's and FDIC backyards. For now, let's just ask the question. Gillian Tett in the FT (see comment at end below)tells us that private sector wholesale funding has dried up. At a Dublin conference I missed the hedge fund experts surmise that Hedge investment capital has shrunk since 2006 from over $2.5tn to close to $1tn! My data says the total is still up in the $2tn region? She also says the banks have stopped their proprietary trading (prop desks) except, in Europe, Goldman Sachs. She also says market-making has retreated, especially in credit markets. So liquidity has crunched, and the question is where is the wall of carpet-bagger money building in 'distressed funds' (the slightly politer term for 'vulture funds') circling and waiting to pounce on fire-sale price deals. Recession is always the time for the cash-rich to get spectacularly richer by buying productive assets, property and securities in anticipation of massive gains when recovery begins. Vulture Funds are building fire-power in the USA, why not in Europe too? Maybe it is all about who gets the Japanese, other Asian and ME sovereign funds on board ($ funds from export-surplus countries)? Ok, so either we invest in vulture funds or we finance banks funding gaps, or we pick up discounted banking-loans assets in securitised bonds at prices where further defaults do no harm, or pick up prime property and land, or maybe all of these. The question is price, timing and getting at the carcasses before the other vultures arrive. Meanwhile, stateside, the US banks are perhaps just treading water, holding hover, suckling at the breast of the Federal Reserve's short term liquidity window? I put this question to my auto-loans liquidity specialist and foreign trips special assistant, Ms Rita Chevrolet, to consider double-entry book-keeping issues of liquidity preferences in banks balance sheet treatments under GAAP, FASB, IAS and IFRS 7.  Certainly, she concluded, if US banks are funding desperately in the shortest term depo money market, we can't rely on them to invest richly in my vulture funds! Almost all new new ABS and CB issuance in the USA died off when Lehman crashed and burned. How are the US banks funding their 'funding gaps' without it and others like it, I asked? Should, I and my other fundsters try to out-compete the Fed's deals and get 9%- 12% returns that way?

Certainly, she concluded, if US banks are funding desperately in the shortest term depo money market, we can't rely on them to invest richly in my vulture funds! Almost all new new ABS and CB issuance in the USA died off when Lehman crashed and burned. How are the US banks funding their 'funding gaps' without it and others like it, I asked? Should, I and my other fundsters try to out-compete the Fed's deals and get 9%- 12% returns that way?  The answer share gave me was that, on the one hand, they (the big banks) are still making money in underlying net interest from traditional banking and, in the other hand, big banks, especially Citibank (Citigroup), JPMC and BoA and Wells Fargo (maybe?) have received a lot of support to buy other big banks, Bear, Wachovia, WaMu and Merrill-Lynch. But, she says, the US banks aren't issuing covered bonds either, or weren't in first half of 2008. U.S. financial institutions sold more than $100 billion of government-backed notes in dollars, euros and British pounds in October to December and now another $300bn back to the Fed, maybe for QE cheques? It helped the banks that FDIC guaranteed their bonds to help them cope with over $770bn of losses and writedowns (including FM&FM). U.S. banks may be doing road-shows in Asia and among sovereign funds. Sales of FDIC-backed notes maturing in more than a year may reach $450bn by the end of June 2009, according to Bloomberg. But whatever's going on, she said, it's hard to get hard data?

The answer share gave me was that, on the one hand, they (the big banks) are still making money in underlying net interest from traditional banking and, in the other hand, big banks, especially Citibank (Citigroup), JPMC and BoA and Wells Fargo (maybe?) have received a lot of support to buy other big banks, Bear, Wachovia, WaMu and Merrill-Lynch. But, she says, the US banks aren't issuing covered bonds either, or weren't in first half of 2008. U.S. financial institutions sold more than $100 billion of government-backed notes in dollars, euros and British pounds in October to December and now another $300bn back to the Fed, maybe for QE cheques? It helped the banks that FDIC guaranteed their bonds to help them cope with over $770bn of losses and writedowns (including FM&FM). U.S. banks may be doing road-shows in Asia and among sovereign funds. Sales of FDIC-backed notes maturing in more than a year may reach $450bn by the end of June 2009, according to Bloomberg. But whatever's going on, she said, it's hard to get hard data?  Whereas the European banks went on issuing ABS in 2008 and a lot of covered bonds to finance their 'funding gaps between customer loans and deposits, gaps that are considerable! And yet the problems of financing the gaps are what makes the credit crunch so-called, that and the ABS and CDO write-downs.

Whereas the European banks went on issuing ABS in 2008 and a lot of covered bonds to finance their 'funding gaps between customer loans and deposits, gaps that are considerable! And yet the problems of financing the gaps are what makes the credit crunch so-called, that and the ABS and CDO write-downs. I suspect that the Euro Area is not quite so much down in recession terms as the most recent GDP data suggested (subject to significant revisions yet to come).

So, I've just returned from discussing all this with my American colleagues, and giving them a few gold-plated steers, at the Silicon Valley of structured finance on St.Patrick's Day, at IMN Clover's Distressed Points Summit: Credit Crunch Investments for Cash-rich held at 'Dan a Point', Uppermill, Seeder Valley, CA, this week, and in the sky wasn’t the only sunshine. All bared their optimism through grated teeth about the dizzying perspective on Distressed Opportunity Assets in 2009 to 2012. I presented the present situation of the UK banking sector and the value of the Government's capitalisation infusions.I spoke about the UK banks and our branch there in that context.

So, I've just returned from discussing all this with my American colleagues, and giving them a few gold-plated steers, at the Silicon Valley of structured finance on St.Patrick's Day, at IMN Clover's Distressed Points Summit: Credit Crunch Investments for Cash-rich held at 'Dan a Point', Uppermill, Seeder Valley, CA, this week, and in the sky wasn’t the only sunshine. All bared their optimism through grated teeth about the dizzying perspective on Distressed Opportunity Assets in 2009 to 2012. I presented the present situation of the UK banking sector and the value of the Government's capitalisation infusions.I spoke about the UK banks and our branch there in that context.

The above graph soared to new heights in the second half of 2008 but the £300bn was almost all for the Bank of England APS, added to which there has been over £600bn in only the last few weeks. We hope to get the management contracts for the pricing and maintenance for suchlike. Interestingly, the optimism shared here echoed what I felt recently at the What's Over the Edge AI fundsters hooley in Philly, PA. My audience at both events comprised the big pension and municipal fund credit-risk p/f, debt-capital managers, and their entertaining clients. The highlights include my thoughts on RMBS described below. I concluded each time by saying, in sum, we are staring into a big dark hole with a big light at the bottom about to switch on and flood out bathing us all in golden sunshine, however artificial of course, of a 'once in several lifetimes' opportunities buying into RMBS in 2009, given the right haircut. As we all know Mark-to-Market causes illiquidity by telling everyone just how one-way the credit market is, except at the shortest end dominated by the central bank liquidity windows and now in recent months the central banks have also taken over 3month, 1 year and MT maturity term markets - it's a race to profit between Government doing ABS asset-swaps and private cash investors trying to get back in on their terms(I advise both). We need a new Big bang Theory, the Standard Theory lacks a mathematically convincing two-way theory of gravity. Time to get back to basics and reconsider what we've been taking for granted.

The above graph soared to new heights in the second half of 2008 but the £300bn was almost all for the Bank of England APS, added to which there has been over £600bn in only the last few weeks. We hope to get the management contracts for the pricing and maintenance for suchlike. Interestingly, the optimism shared here echoed what I felt recently at the What's Over the Edge AI fundsters hooley in Philly, PA. My audience at both events comprised the big pension and municipal fund credit-risk p/f, debt-capital managers, and their entertaining clients. The highlights include my thoughts on RMBS described below. I concluded each time by saying, in sum, we are staring into a big dark hole with a big light at the bottom about to switch on and flood out bathing us all in golden sunshine, however artificial of course, of a 'once in several lifetimes' opportunities buying into RMBS in 2009, given the right haircut. As we all know Mark-to-Market causes illiquidity by telling everyone just how one-way the credit market is, except at the shortest end dominated by the central bank liquidity windows and now in recent months the central banks have also taken over 3month, 1 year and MT maturity term markets - it's a race to profit between Government doing ABS asset-swaps and private cash investors trying to get back in on their terms(I advise both). We need a new Big bang Theory, the Standard Theory lacks a mathematically convincing two-way theory of gravity. Time to get back to basics and reconsider what we've been taking for granted.  Corporate debt is too volatile for going long or 'long' strategies, alongside CDOs and CLOs; best to surf round turning points on v.short-term 2% = 50xleverages. Bit early for Commercial MBS except for secret fire-sale deals. Government isn’t helping the credit-marketeers with mortgage cram-downs and slam-dunk liquidity window giant swaps enjoying 30% haircuts on A+ paper already at 70-80

Corporate debt is too volatile for going long or 'long' strategies, alongside CDOs and CLOs; best to surf round turning points on v.short-term 2% = 50xleverages. Bit early for Commercial MBS except for secret fire-sale deals. Government isn’t helping the credit-marketeers with mortgage cram-downs and slam-dunk liquidity window giant swaps enjoying 30% haircuts on A+ paper already at 70-80 Governments' unlimited fiat-money has changed the “rules of the game.” But so far, still a richly-rewarding, one-way buyers' market if you've no qualms depriving taxpayers of big MT gains, and don't feel moral queasiness of adding yet more mega-bonuses to your 2008 Christmas came every day and twice on Sundays shorting profits. My friends Soros, Nebachudnezzer, Ozymandius and Buffett have such moral thoughts

This I will share with King Midas (Mervyn) and tell him this is all about who is allowed to be the carpet-baggers of the credit crunch global recession (first recession where aggregate of world GDP could become negative?) - the shadow-banks & friends who profited on way down, now have far more gain on way up - it is them or the public sector who makes biggest returns (at least the latter is on everyone's behalf and that risked to bail out economy & the finance markets?)I wonder if European banks are lending to the US banks in place of paying up their dollar gap, the euro-dollar system at work?

My advice to clients such as Don Di Bias (Advantus), Larry Poker (Paulson), Mikey Picko'raro (NPM), Mick 'to model' Clark (Meridian), Johnny d'Pluto (Declaration M&R), Michel Levitt (Stone Tower), Johnny 'pibroch' Morrison (Asymtotix) and his namesake at Macquarie, Phill "fill ‘em while they're hot” Baruch (Trust Co.West) are that we face immediate opportunities in selected RMBS (picked using my REvolutionary Super-Computer UE harness, caveat “get 'em cheap” and investor firms with cash can indeed.I can factor in any structure and any type of market participant.

My advice to clients such as Don Di Bias (Advantus), Larry Poker (Paulson), Mikey Picko'raro (NPM), Mick 'to model' Clark (Meridian), Johnny d'Pluto (Declaration M&R), Michel Levitt (Stone Tower), Johnny 'pibroch' Morrison (Asymtotix) and his namesake at Macquarie, Phill "fill ‘em while they're hot” Baruch (Trust Co.West) are that we face immediate opportunities in selected RMBS (picked using my REvolutionary Super-Computer UE harness, caveat “get 'em cheap” and investor firms with cash can indeed.I can factor in any structure and any type of market participant.  The market is ripening like Spring, with 30-40% returns on RMBS trading at postage stamp rates $0.40c. Time is now, '09 = Big Opportunity REturns in Short- to less-short term. DIStressed CREDIT over 5-6 year strategy = '08-09: Stressed housing market, '09-11: Stressed Consumer Credit, '10-13: Commercial Real Estate only if you think CRE lags economic weakness (I don't). Housing correction is 2.5 years into its peak to peak 7 year cycle. Forecasts to my investors on frequency & severity of loss, amortised run-off and cash-flow balloons sell like hot-cakes. Corporate defaults just starting look tremendous volatility for inter-day trades. Buying into RMBS with short, predictable cash flows is effective for quarterly plays, better per year than 7+ years for corporate debt coupons after knocking off the insurance. (This viewpoint on corporate debt was shared by many fellow carpetbaggers – too much volatility for self-respecting investors and too early to know where best opportunities are firmest.)

The market is ripening like Spring, with 30-40% returns on RMBS trading at postage stamp rates $0.40c. Time is now, '09 = Big Opportunity REturns in Short- to less-short term. DIStressed CREDIT over 5-6 year strategy = '08-09: Stressed housing market, '09-11: Stressed Consumer Credit, '10-13: Commercial Real Estate only if you think CRE lags economic weakness (I don't). Housing correction is 2.5 years into its peak to peak 7 year cycle. Forecasts to my investors on frequency & severity of loss, amortised run-off and cash-flow balloons sell like hot-cakes. Corporate defaults just starting look tremendous volatility for inter-day trades. Buying into RMBS with short, predictable cash flows is effective for quarterly plays, better per year than 7+ years for corporate debt coupons after knocking off the insurance. (This viewpoint on corporate debt was shared by many fellow carpetbaggers – too much volatility for self-respecting investors and too early to know where best opportunities are firmest.) Fundamentals are always a challenge, to market outsiders, finding a willing seller at these prices can only be among the over-leveraged AI merchants and disintegrated banks like Fortis and ABN AMRO, but how many more of those can we find, gold-dust, if you can trust the accounting. Asset holders subject to mark-to-market fair-value need to protect their p/l, especially banks with dominant government shareholders who want profitable exits sooner than later and aren't too anxious to wait for the bigger pay-offs, so they're swap-repo-selling small juicy portions of their bond-packaged loan portfolios at 40c/$1, down from the 60c or 70c where currently marked. To go further would require the banks (selling privately, directly, or via SIV or Warehouse intermediaries) to re-mark all remaining loan assets on the books, and risk analysts' views feeding through to the ratings agencies! This would wreak havoc on most banks’ capital ratios far more than narrow the banks 'funding gaps', causing bank regulators to step in and shut down banks for 'capital insolvency' where the 40c sale revenue equates to 40+% 'funding gaps'. No signs of improvement in the illiquid MT & 3m credit and money market – there’s not much activity right now because of the mark-to-market effects on sell-siders, only suits those of us with deepest pockets and more of them than a busy snooker club. The US banks have raised more than they've written down in 2008, half of it from government. They lost 75% of their capital reserves ($1tn) and have replaced 80% of that so they are well provisioned for some more big haircuts yet to come onstream?

Fundamentals are always a challenge, to market outsiders, finding a willing seller at these prices can only be among the over-leveraged AI merchants and disintegrated banks like Fortis and ABN AMRO, but how many more of those can we find, gold-dust, if you can trust the accounting. Asset holders subject to mark-to-market fair-value need to protect their p/l, especially banks with dominant government shareholders who want profitable exits sooner than later and aren't too anxious to wait for the bigger pay-offs, so they're swap-repo-selling small juicy portions of their bond-packaged loan portfolios at 40c/$1, down from the 60c or 70c where currently marked. To go further would require the banks (selling privately, directly, or via SIV or Warehouse intermediaries) to re-mark all remaining loan assets on the books, and risk analysts' views feeding through to the ratings agencies! This would wreak havoc on most banks’ capital ratios far more than narrow the banks 'funding gaps', causing bank regulators to step in and shut down banks for 'capital insolvency' where the 40c sale revenue equates to 40+% 'funding gaps'. No signs of improvement in the illiquid MT & 3m credit and money market – there’s not much activity right now because of the mark-to-market effects on sell-siders, only suits those of us with deepest pockets and more of them than a busy snooker club. The US banks have raised more than they've written down in 2008, half of it from government. They lost 75% of their capital reserves ($1tn) and have replaced 80% of that so they are well provisioned for some more big haircuts yet to come onstream?  But, when will liquidity start to flow? Maybe when the Carpetbag Clubbers get into buying distressed ABS at sufficiently deep discounts to leverage against at negative cost? There is liquidity flowing, but right now only from government to banks. And the governments are imposing 25-30% haircut and levering big fees so it ain't cheap money, but it is money, the best kind in exchange for the worst kind of currently semi-liquid assets. Governments are taking the banks' impaired assets on am equivalent to a swap-repo basis and thereby removing the M2M market risk from banks' balance sheets, while also ensuring governments get their preference share coupons and other dividends paid plus better prospects for bank shares rebounding. The banks need the money to fund their funding gaps and that locks out the private sector from what was a lucrative business. Great time though for the insurers to buy very long term paper at good discount and high LIBOR Plus rates.

But, when will liquidity start to flow? Maybe when the Carpetbag Clubbers get into buying distressed ABS at sufficiently deep discounts to leverage against at negative cost? There is liquidity flowing, but right now only from government to banks. And the governments are imposing 25-30% haircut and levering big fees so it ain't cheap money, but it is money, the best kind in exchange for the worst kind of currently semi-liquid assets. Governments are taking the banks' impaired assets on am equivalent to a swap-repo basis and thereby removing the M2M market risk from banks' balance sheets, while also ensuring governments get their preference share coupons and other dividends paid plus better prospects for bank shares rebounding. The banks need the money to fund their funding gaps and that locks out the private sector from what was a lucrative business. Great time though for the insurers to buy very long term paper at good discount and high LIBOR Plus rates. Right now, there's roughly $1.4tn RMBS currently on offer in the US, even after the Fed's $300bn slam dunk. And there'll be forced sale situations from secondary market structured product funds through '09. The Fed's purchase of FM&FM assets at Agency and sub-prime spreads is like a cheap share buy-back. Has the Fed or the Bank of England or the ECB got the analytics such as I have for valuing all forms of structured product?

Carpetbagger Club members agree with me. They say stuff like, "dose depress-price RMBS don' mean dem assets is distressed f'sho', onny priced as distress' wuz like loan portfolios is priced as non-performing when deez 'ere default rates is bein' sticky between 1.5% (normal 45% recovery rates) an' 3.5% (30% recoveries)". I tell them, "that's certainly most interesting and insightful". That's the Veronica of the deal. I next show the Espada (Estoque) saying, "but lookee here this requires asset modelling at loan level, then integrating at property-level, plus macro-analysis using my super-computer right here (my Traje de luces). See, IRRBB securitized bond driver is price at sale, cash-yields, & recoveries less cost-haircuts at defaults + mitigants for smoothing like the 30% of borrower income idea and other stuff like mortgagee re-contracting and new IR settings, and principal 'aromatization' (amortization with a play-nice smell)". That Puntilla gets their attention. Then I finish with my "tercio del momento supremo".

Carpetbagger Club members agree with me. They say stuff like, "dose depress-price RMBS don' mean dem assets is distressed f'sho', onny priced as distress' wuz like loan portfolios is priced as non-performing when deez 'ere default rates is bein' sticky between 1.5% (normal 45% recovery rates) an' 3.5% (30% recoveries)". I tell them, "that's certainly most interesting and insightful". That's the Veronica of the deal. I next show the Espada (Estoque) saying, "but lookee here this requires asset modelling at loan level, then integrating at property-level, plus macro-analysis using my super-computer right here (my Traje de luces). See, IRRBB securitized bond driver is price at sale, cash-yields, & recoveries less cost-haircuts at defaults + mitigants for smoothing like the 30% of borrower income idea and other stuff like mortgagee re-contracting and new IR settings, and principal 'aromatization' (amortization with a play-nice smell)". That Puntilla gets their attention. Then I finish with my "tercio del momento supremo". At current price levels, 17-25% IRR is realistic and RMBS offers a good “margin of safety.” The primary risk lies in government cram-downs of sub-prime mortgages, where 60% of sub-prime loans are currently performing to 10-12% heading for 25% (representing in turn about 25% of US RMBS, but the discerning buyer can get half that first-loss protected and still come good with double-digit returns. fact is, as i tell everyone I know, it's time they caught up with the latest most modern financial products.

Some fools say,“Just because it’s cheap doesn’t mean that it’s cheap, or that it won’t get cheaper.” Government’s actions introduce opportunity constraints for private buyers in the distressed credit market esp. in RMBS. Why would RMBS holders sell at 40 when they can wait for a government bailout and get 75? Well only 80% of holders can do that. They are the systemically important big banks. That leaves $2.8tn of paper out there to play for, plus what's left behind in the banks vaults, and another $1.5tn maybe available in Europe and Asia for say that looks good when you've got US dollars to buy with and want to book a US mega-profit when the dollar falls later this year and next. £ Sterling holders would be happy to sell just now for $ dollars at 40-50c.There is life in these assets!

Some fools say,“Just because it’s cheap doesn’t mean that it’s cheap, or that it won’t get cheaper.” Government’s actions introduce opportunity constraints for private buyers in the distressed credit market esp. in RMBS. Why would RMBS holders sell at 40 when they can wait for a government bailout and get 75? Well only 80% of holders can do that. They are the systemically important big banks. That leaves $2.8tn of paper out there to play for, plus what's left behind in the banks vaults, and another $1.5tn maybe available in Europe and Asia for say that looks good when you've got US dollars to buy with and want to book a US mega-profit when the dollar falls later this year and next. £ Sterling holders would be happy to sell just now for $ dollars at 40-50c.There is life in these assets!  This spawned some Bohemian Grove style chats about the lack of “rule of law” in the credit markets. Most managers feel the government’s spurts of activity is unsettling. But, I just calm the anxiety by putting some numbers on outcomes for a Performing ABS Loan Portfolio whereby baseline ROI reaches 17% (or higher closer to 40s): Default rate of 10% per year; Prepayment 5% per year; Recovery Rate 50% less hc; and hey presto the AAA is back up trading at par! The greediest clients like the 17% but but hop market price will strike at 40c/$, not 50c-60c range. When stock markets crashed it was also because institutional investors sold stock and held cash (& near-cash) and some/many are cash-rich with once in lifetime opportunity to buy in at the bottom of bottoms. It was not just my short-selling friends who did the damage, though plenty of that too, but as we say where would we be if the institutions wouldn't agree to our renting their stock and sending it back trashed - just like rock bands in their hotel rooms - lot of fun for money. Short-sellers are the new rock & roll!

This spawned some Bohemian Grove style chats about the lack of “rule of law” in the credit markets. Most managers feel the government’s spurts of activity is unsettling. But, I just calm the anxiety by putting some numbers on outcomes for a Performing ABS Loan Portfolio whereby baseline ROI reaches 17% (or higher closer to 40s): Default rate of 10% per year; Prepayment 5% per year; Recovery Rate 50% less hc; and hey presto the AAA is back up trading at par! The greediest clients like the 17% but but hop market price will strike at 40c/$, not 50c-60c range. When stock markets crashed it was also because institutional investors sold stock and held cash (& near-cash) and some/many are cash-rich with once in lifetime opportunity to buy in at the bottom of bottoms. It was not just my short-selling friends who did the damage, though plenty of that too, but as we say where would we be if the institutions wouldn't agree to our renting their stock and sending it back trashed - just like rock bands in their hotel rooms - lot of fun for money. Short-sellers are the new rock & roll!  Funds with the best actuaries have the best forecasting economists and many are public pension sector funds, though they can't work out that stock lending is foolish in turbulent markets? So what we see is rich 'jump in deep end' stuff. But, within the complex world of distressed investments, lies a labyrinth of contractual issues. With good advice, public pension funds & institutional investors can be led through the complicated legal web of the distressed arena. My firm's expertise is the practicalities of the marketplace- legal/ contractual expertise and specialized added-value-pricing trading-to-banking-book requirements. Using our analysis I evidenced the case of US big 6 banks and the different capital reserve schedules that occur whether banks discount their ABS by 25% or 50% more, and why the lower rate is obviously so much safer for them. Hence, I was saying forget about 40c on the $, take 50c-60c and wait for return to 85c.

Funds with the best actuaries have the best forecasting economists and many are public pension sector funds, though they can't work out that stock lending is foolish in turbulent markets? So what we see is rich 'jump in deep end' stuff. But, within the complex world of distressed investments, lies a labyrinth of contractual issues. With good advice, public pension funds & institutional investors can be led through the complicated legal web of the distressed arena. My firm's expertise is the practicalities of the marketplace- legal/ contractual expertise and specialized added-value-pricing trading-to-banking-book requirements. Using our analysis I evidenced the case of US big 6 banks and the different capital reserve schedules that occur whether banks discount their ABS by 25% or 50% more, and why the lower rate is obviously so much safer for them. Hence, I was saying forget about 40c on the $, take 50c-60c and wait for return to 85c.

If US banks' distressed assets are therefore less appealing, I counseled the attractions (upside currency risk) of dramatic rises in distressed opportunities in Europe and Asia due to increased default rates resulting from an inability for companies to service debts. Although conditions vary between regions, both Europe and Asia are feeling the effects of the credit crunch turmoil. We have specialists who analyze why funds should consider investing outside the USA:- the driving forces behind the surge of European and Asian distressed investing - most appealing sectors and cycles to public pension funds - case studies of public pension fund investing in European and/or Asian distressed markets and of municipal bond issuers trying to trace their bondholders to buy the stock back at half price! Our Outlook for 2009: Will others follow our lead, and with how much $ and who? We quite happily will advise the public sector buyers too.

If US banks' distressed assets are therefore less appealing, I counseled the attractions (upside currency risk) of dramatic rises in distressed opportunities in Europe and Asia due to increased default rates resulting from an inability for companies to service debts. Although conditions vary between regions, both Europe and Asia are feeling the effects of the credit crunch turmoil. We have specialists who analyze why funds should consider investing outside the USA:- the driving forces behind the surge of European and Asian distressed investing - most appealing sectors and cycles to public pension funds - case studies of public pension fund investing in European and/or Asian distressed markets and of municipal bond issuers trying to trace their bondholders to buy the stock back at half price! Our Outlook for 2009: Will others follow our lead, and with how much $ and who? We quite happily will advise the public sector buyers too.  Dramatic rises expected in distressed opportunities in Europe and Asia due to increased default rates (inability of companies to service debts - already S&P500 EBIDTA = only 100% of interest payments! this is not good news. I want good news. This is the time for future-perfect not past-imperfect thinking. This I fleshed out on the blackboard - good old traditional technology.

Dramatic rises expected in distressed opportunities in Europe and Asia due to increased default rates (inability of companies to service debts - already S&P500 EBIDTA = only 100% of interest payments! this is not good news. I want good news. This is the time for future-perfect not past-imperfect thinking. This I fleshed out on the blackboard - good old traditional technology. Conditions lag-vary between Europe and Asia in feeling effects of credit crunch turmoil(tsunami arrival rates meeting 'surge' of 'surfers', also known as, carpetbagger investment funds). Specialists will analyze why public funds should consider investing outside United States (especially just when US $ is riding v.high +30% to £ where half of Europe's ABS resides):

Conditions lag-vary between Europe and Asia in feeling effects of credit crunch turmoil(tsunami arrival rates meeting 'surge' of 'surfers', also known as, carpetbagger investment funds). Specialists will analyze why public funds should consider investing outside United States (especially just when US $ is riding v.high +30% to £ where half of Europe's ABS resides): • driving forces behind surge of European & Asian distressed investing

• most appealing sectors & cycles? - how to identify them?

• Case study work - public fund investing in European & Asian distressed markets

• Outlook for 2009 - how much and how many others will follow?

Which sectors afford the best prospect to leverage returns.

Analyze where next opportunities appear - look at the distressed markets - most popular sectors for distressed investments - Opportunities this quarter, this year - driving forces behind funds' decision to use Our Opportunity Funds? - positioning these assets into present strategy? - super-calc of risk/rewards of investing in OOFs? When share prices of bank stocks are the price of postage stamps (see example of the recent Bond 'forever stamps' I've invested in that will soon be showing 8% returns, and no stamp-duty or capital-gains tax?) to allocate assets to distressed investments is a matter of 1. timing; early/ middle/ later in distressed cycles? - 2. valuation - 3. performance measurement - 4. defaults & their corresponding distress-cycles - 5. relative risk - 6. upside potential - 7. plan to leverage value into the future. I surprise folks with my Stamp Bond returns compared to bank stocks.

I tell clients what it is attracting them to invest early/middle/later in distressed cycles and how they plan to leverage value into the future and then hand them my T&Cs (business cards are for wimps). When Buying value under par (adage "the day you buy is the day you sell": present valuation NPV & performance measurement - Limited supply & high demand of distressed debt & equities - Future outlook: review of defaults & desire to get to the party before it’s over - Beyond timing: commitments from hedge funds & private equity firms to invest in opportunities that meet targeted benchmarks.

I tell clients what it is attracting them to invest early/middle/later in distressed cycles and how they plan to leverage value into the future and then hand them my T&Cs (business cards are for wimps). When Buying value under par (adage "the day you buy is the day you sell": present valuation NPV & performance measurement - Limited supply & high demand of distressed debt & equities - Future outlook: review of defaults & desire to get to the party before it’s over - Beyond timing: commitments from hedge funds & private equity firms to invest in opportunities that meet targeted benchmarks.  To optimize distressed cycle & provide practical aspects of integrating distressed opportunities into the institutional portfolio: - Successfully identifying assets showing distress & maximizing on opportunities - How distressed debt investors can profit from subprime mortgage meltdown - Distressed debt development & investment opportunities in key markets - Understanding deal structures & implementing creative strategies.

To optimize distressed cycle & provide practical aspects of integrating distressed opportunities into the institutional portfolio: - Successfully identifying assets showing distress & maximizing on opportunities - How distressed debt investors can profit from subprime mortgage meltdown - Distressed debt development & investment opportunities in key markets - Understanding deal structures & implementing creative strategies.Capital for leverage buyout transactions from institutional investors & pension funds (+ lease-finance style from banks) who pulled money out of the stock market in search of higher returns, some are sitting on record amounts of capital and will seek opportunities designed to meet higher opportunity OOF benchmarks - to target distress-funds for desirable takeovers. For these we provide: - Trend line: Investment cycle review - Baseline for returns-looking out onto the investment horizon - How is distressed market expanding or contracting? I gave the example of my very own private bank, Banque Rupp et cie and how 2008 impacted our funding liquidity. I explained how typical we are of the sector and on the basis of our trillion (multi-currency) balance sheet, using our own IFRS enhanced accounting standard how one third of our balance is annually refreshable after the capital has been wiped out 150%, even though we remain profitable if not for our ABS writedown that we only take on balance sheet to satisfy the investors in it how much we care albeit the tax authority has a few questions about how macro-prudentially and micro-prudently we record our P/L loss.

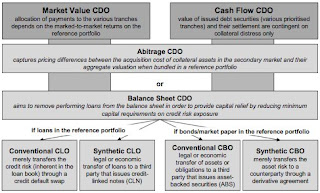

I had to present recently to a panel of our institutional investors about our various responses to the new liquidity-distressed market conditions and why we now consider our off-balance sheet vehicles to be vulture fund opportunity for private banking HNW clients. Public and private sector pension funds are also raising capital to take advantage of current opportunities from supply/demand imbalance in market for mortgage-related and other assets like ours: - we statistically report in weekly detail on residential & commercial mortgage-backed securities and the underlying that supports our various MBS collateralized debt obligations, collaterized loan obligations (CLOs), single-name & index credit default swaps on CDOs, and how these compare to our whole-loan risk-buckets, soon to be in new CDO repo-packages and investment funding repo packs too (prospectuses mailed-out subject to your last 3 years margin call history & NSIMA series 7 SEC certifications - no prime brokers or ex- Lehmans, AAB, Fortis, UBS, Citi, RBS-GC or other ex-structured product prop-desk execs need apply).

I had to present recently to a panel of our institutional investors about our various responses to the new liquidity-distressed market conditions and why we now consider our off-balance sheet vehicles to be vulture fund opportunity for private banking HNW clients. Public and private sector pension funds are also raising capital to take advantage of current opportunities from supply/demand imbalance in market for mortgage-related and other assets like ours: - we statistically report in weekly detail on residential & commercial mortgage-backed securities and the underlying that supports our various MBS collateralized debt obligations, collaterized loan obligations (CLOs), single-name & index credit default swaps on CDOs, and how these compare to our whole-loan risk-buckets, soon to be in new CDO repo-packages and investment funding repo packs too (prospectuses mailed-out subject to your last 3 years margin call history & NSIMA series 7 SEC certifications - no prime brokers or ex- Lehmans, AAB, Fortis, UBS, Citi, RBS-GC or other ex-structured product prop-desk execs need apply).  Golf footnote: in the afternoons of our conferences after the hectic breakfast sessions attendees are invited to play in IMN's Golf Invitational at Monarch Beach Golf Links' pristine location, along with abundant amenities that offer guests an enjoyable experience, truly unforgettable. The course has been host to nationally televised events with top golfers of all three capital markets with money leaders from the PGA, Senior PGA and LGPA tours with coaching tips from Arnold Palmer, Jack Nicklaus, Tom Watson, Fred Couples, Tom Kite, Julie Inkster and Dottie Pepper who have all spiritly competed on this picturesque course, where our Tees & Cees were finalised on leveraging the subprime situation, turning handicaps into par, losses into profits, water into wine!

Golf footnote: in the afternoons of our conferences after the hectic breakfast sessions attendees are invited to play in IMN's Golf Invitational at Monarch Beach Golf Links' pristine location, along with abundant amenities that offer guests an enjoyable experience, truly unforgettable. The course has been host to nationally televised events with top golfers of all three capital markets with money leaders from the PGA, Senior PGA and LGPA tours with coaching tips from Arnold Palmer, Jack Nicklaus, Tom Watson, Fred Couples, Tom Kite, Julie Inkster and Dottie Pepper who have all spiritly competed on this picturesque course, where our Tees & Cees were finalised on leveraging the subprime situation, turning handicaps into par, losses into profits, water into wine!

1 comment:

Insight: Where are the Gordon Gekkos?

By Gillian Tett

Published: March 19 2009 16:19 | Last updated: March 19 2009 17:05

Where is Gordon Gekko when you really need him? That is a question many financiers might ask right now. In recent days, politicians on both sides of the Atlantic have railed against the antics of “greedy” speculators – and vowed to clamp down on unbridled risk-taking.

But deep in the bowels of the financial system, an entirely different type of hand-wringing is afoot. For one of the real problems in the markets is not too much greed – but a desperate shortage of risk-taking speculation in almost any form.

21st century CDO-touting version of Gordon Gekko – the iconic greed-driven figure from the film Wall Street – has gone on strike. And while few politicians or pundits might mourn that trend, this disappearance of risk capital is a key reason why so much of the financial machinery is currently failing to work.

Measuring the scale of this shift is distinctly hard. But some recent anecdotes are chilling. Last week, for example, a group of senior hedge fund players and chief investment officers gathered in Dublin – and collectively guessed that about 80 per cent of the risk capital that was sitting in the European system a year ago has disappeared. In part that reflects a stunning wave of deleveraging and redemptions among hedge funds. Back in 2008, the global hedge fund industry had some $2,600bn of assets, according to Hedge Fund Intelligence, a research group. The hedge fund gurus gathered in Dublin last week, though, reckoned that sum would be near $1,000bn by the end of this year (and some projected dramatically lower).

What is even more dramatic – but less visible – is the disappearance of banks’ proprietary trading desks. In recent weeks, some banks have publicly announced that they are shutting or mothballing these, either in response to political pressure, market scrutiny – or simple despair about the inability to devise any rational trading strategy in current markets.

Other banks have taken more furtive action. Either way, traders in London say there is really only one bank in Europe which is even pretending to run an active prop desk now – namely Goldman Sachs. As a result, billions of dollars of risk-taking capital is believed to have quietly vanished.

That has had all manner of extraordinary consequences. Two years ago, a host of hedge funds and prop desks in London were building up their distressed debt-trading teams to take advantage of a future turn in the credit cycle. Logic might suggest such funds should be wildly busy right now, swooping in to buy distressed companies, or securities. Nothing could be further from the truth. As banks have slashed their risk-taking operations, they have also cut their distressed prop desks, and most have stopped making markets in distressed products. Hedge funds dealing with distressed assets have also folded, unable to raise funds.

As a result, there is a dire shortage of capital to organise – or fund – even “simple” restructurings of companies, distressed investment entities or anything else. Hence the gridlock on dealing with toxic assets.

But not just credit assets are being hit. As asset managers hunt for places to put their cash away from the carnage of the credit or property world, some have been tempted by the world of small-cap equities. But trading in small caps can only take place with market makers – and right now, banks are not just cutting prop desks but market making activity too. As a result, fund managers are sitting on their hands. “We would love to buy small caps but we just cannot tolerate the liquidity risk,” explains one large asset manager. “Almost any sector which needs marketmakers is half-dead.” Logic would suggest that eventually this pattern should change. After all, oodles of cash remain in the system. That cannot all stay in government bonds for ever, least of all in a world where the Fed is busy intervening in such a dramatic fashion to suppress yields.

The good news for the asset management industry is that as the high-rolling, highly leveraged hedge funds disappear, the problem of investor “crowding out” is disappearing too. That should make it easier for unleveraged asset managers to make a decent return from “simple” strategies – which in turn should tempt them back in.

Indeed, some bankers think – or desperately hope – this week’s equity rally could reawaken animal spirits soon. But before the mainstream players dive in on a large scale, they need to know there will be institutions around who are willing to make markets – or speculators who are willing stand on the other side of trades, running risks that the mainstream players do not want to bear. Gordon Gekko – or, at least, a pool of risk capital – needs to exist for finance to flourish.

The crucial question in the short- and medium-term is, who will play that role? Banks? Boutiques? Asset managers themselves? Or something else altogether? Answers please on a postcard – and preferably sent to the politicians and regulators, who are angrily fulminating about what the future of finance should be.

Post a Comment